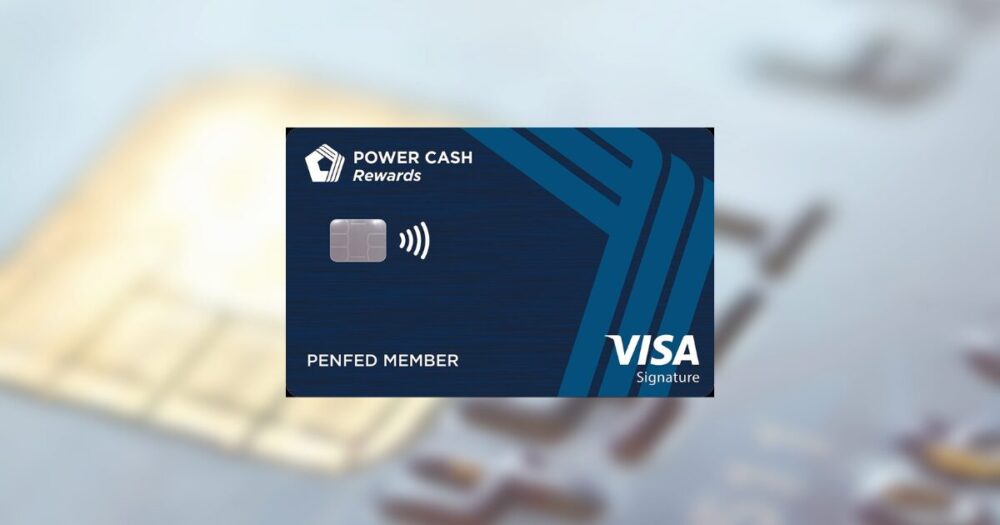

Apply for Power Cash Rewards Visa Signature Credit Card Easily

The world of credit cards is vast, but if you’re looking for a seamless blend of ease and reward, the Power Cash Rewards Visa Signature Credit Card stands out. Designed to simplify your financial life while enhancing your purchasing power, this card offers a straightforward application process. Imagine earning cash back on every purchase, making every swipe more rewarding. It’s like having a small reward in your pocket, ready when you need it.

This card doesn’t just stop at providing rewards. It also offers unique benefits tailored to your lifestyle. From travel insurance to fraud protection, the card is packed with features that offer peace of mind. Plus, if you’re someone who values streamlined financial management, the integration with digital banking solutions makes tracking your spending a breeze. Delve deeper into its features, and see how it can complement your financial journey.

Benefits of the Power Cash Rewards Visa Signature Credit Card

1. Unlimited Cash Back

The Power Cash Rewards Visa Signature Credit Card offers an impressive 1.5% cash back on every purchase, every day. This means that whether you’re buying groceries, paying utility bills, or dining out, you can earn cash back on all your spending. To maximize this benefit, consider using your card for regular daily expenses to steadily accumulate cash back rewards. Pay your balance in full each month to avoid interest charges that could offset your rewards.

2. No Annual Fee

This credit card comes with no annual fee, which means you won’t have to worry about yearly charges just to keep the card in your wallet. Without an annual fee, a larger portion of your rewards can be used towards your financial goals. It’s especially beneficial for cardholders who like to save on unnecessary fees while still enjoying the benefits of a rewards program.

3. Introductory Offer

New cardholders can benefit from a generous introductory offer. Often, credit cards come with a bonus, such as additional cash back, when spending a certain amount within the first few months. This is a perfect opportunity to earn a significant cash back bonus on expenses you may have planned, like home improvements or holiday shopping. Be sure to check current offers when you apply to take full advantage of this perk.

4. Flexible Redemption Options

With the Power Cash Rewards Visa Signature, you can access your cash rewards easily. Whether you prefer direct deposits to your bank account or statement credits that reduce your balance, there is flexibility in how you redeem your rewards. This flexibility allows you to tailor the benefit to your personal financial strategy, making the most out of your rewards.

VISIT THE WEBSITE TO LEARN MORE

| Category | Advantages |

|---|---|

| Cash Back Rewards | Earn 2% cash back on grocery store and wholesale club purchases, enhancing your savings. |

| Flexible Redemption | Redeem rewards for statement credits, gift cards, or travel, providing versatile options for your earnings. |

Key Requirements to Apply for the Power Cash Rewards Visa Signature Credit Card

- Minimum Credit Score: To be eligible for the Power Cash Rewards Visa Signature Credit Card, a minimum credit score of 700 is generally recommended. This ensures that you have a good credit standing, which is crucial for navigating financial opportunities.

- Proof of Income: Applicants must provide proof of a stable income. Whether you are a salaried employee or self-employed, having your recent pay stubs or tax returns ready will demonstrate your ability to manage credit responsibly.

- Bank Account Information: You will need to provide details of your existing bank accounts. This is used to verify your financial reliability and your ability to handle credit transactions.

- Identification Documents: A valid government-issued ID, such as a driver’s license or passport, is necessary. This helps in verifying your identity during the application process.

- U.S. Residency: Only U.S. citizens or permanent residents are usually eligible to apply for this credit card. Be ready with documentation that confirms your residency status.

SEE HOW TO GET YOUR POWER CASH REWARDS VISA SIGNATURE CREDIT CARD

How to Apply for the Power Cash Rewards Visa Signature Credit Card

Step 1: Visit the PenFed Website or Local Branch

Begin your application process by visiting the PenFed website. You can use your internet browser to navigate to their official site. If you prefer face-to-face interaction, you can also visit a local PenFed branch. For online applicants, look for the section dedicated to credit card applications. This will usually be prominently displayed on the homepage, making it easy to find.

Step 2: Select the Power Cash Rewards Visa Signature Credit Card

Once on the PenFed website or at the branch, locate the section for credit cards. Review the available options and select the Power Cash Rewards Visa Signature Credit Card. You will typically find a detailed description of the card’s features and benefits here, allowing you to confirm that this is the right choice for your financial needs.

Step 3: Start Your Application

Click on the application link for the Power Cash Rewards Visa Signature Credit Card. For those applying online, complete the application form by filling out your personal information, financial details, and any other required fields. Ensure all information is accurate to avoid any processing delays. If you’re at a branch, a representative will guide you through filling the required paperwork.

Step 4: Submit the Application

After completing the application form, submit it online or hand it over to the branch representative. Ensure you’ve reviewed all the details for accuracy. For online submissions, you will typically receive a confirmation email. At the branch, a representative will confirm the submission.

Step 5: Await Approval

Once your application is submitted, the PenFed team will review it. Approval times can vary, but typically you can expect a decision within a few business days. You will be notified via email or phone with the final decision. If approved, your new Power Cash Rewards Visa Signature Credit Card will be mailed to your address.

LEARN MORE DETAILS ABOUT POWER CASH REWARDS VISA SIGNATURE CREDIT CARD

Frequently Asked Questions about the Power Cash Rewards Visa Signature Credit Card

What are the primary benefits of the Power Cash Rewards Visa Signature Credit Card?

The Power Cash Rewards Visa Signature Credit Card offers a variety of benefits, including up to 2% cash back on all purchases. This card is designed for those who enjoy rewards without the hassle of rotating categories or spending limits. It also provides additional perks like travel and emergency assistance services, auto rental collision damage waiver, and access to exclusive events and experiences.

Is there an annual fee associated with this credit card?

A significant advantage of the Power Cash Rewards Visa Signature Credit Card is that it does not charge an annual fee. This makes it a great option for those who want to maximize their rewards without incurring extra costs. However, it’s important to review the full terms for any potential fees related to other services.

What credit score is needed to qualify for this credit card?

Generally, you will need a good to excellent credit score to qualify for the Power Cash Rewards Visa Signature Credit Card. This typically means a credit score of 700 or above. Keep in mind that additional factors, such as your credit history and income, also play a role in the approval process.

How does the cash back redemption process work?

With the Power Cash Rewards Visa Signature Credit Card, redeeming cash back is straightforward. You can apply your cash back rewards as a statement credit to reduce your balance, or you could also receive it as a direct deposit to a checking or savings account. Redemption options may vary, so it’s advisable to check with your card issuer for specific guidelines.

Related posts:

How to Apply for an Oportun Loan Easy Steps Requirements

How to Apply for US Bank FlexPerks Gold American Express Credit Card

How to Apply for HSBC Premier World Mastercard Credit Card Easily

How to Apply for Bank of America Customized Cash Rewards Credit Card

How to Apply for the Chase Freedom Unlimited Credit Card Effortlessly

The Impact of Credit Cards on the Financial Health of Young Adults

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on our platform. Her goal is to empower readers with practical advice and strategies for financial success.